Some Known Facts About Transaction Advisory Services.

Table of ContentsTransaction Advisory Services Things To Know Before You BuySee This Report on Transaction Advisory ServicesThe Single Strategy To Use For Transaction Advisory ServicesThe Single Strategy To Use For Transaction Advisory ServicesUnknown Facts About Transaction Advisory Services

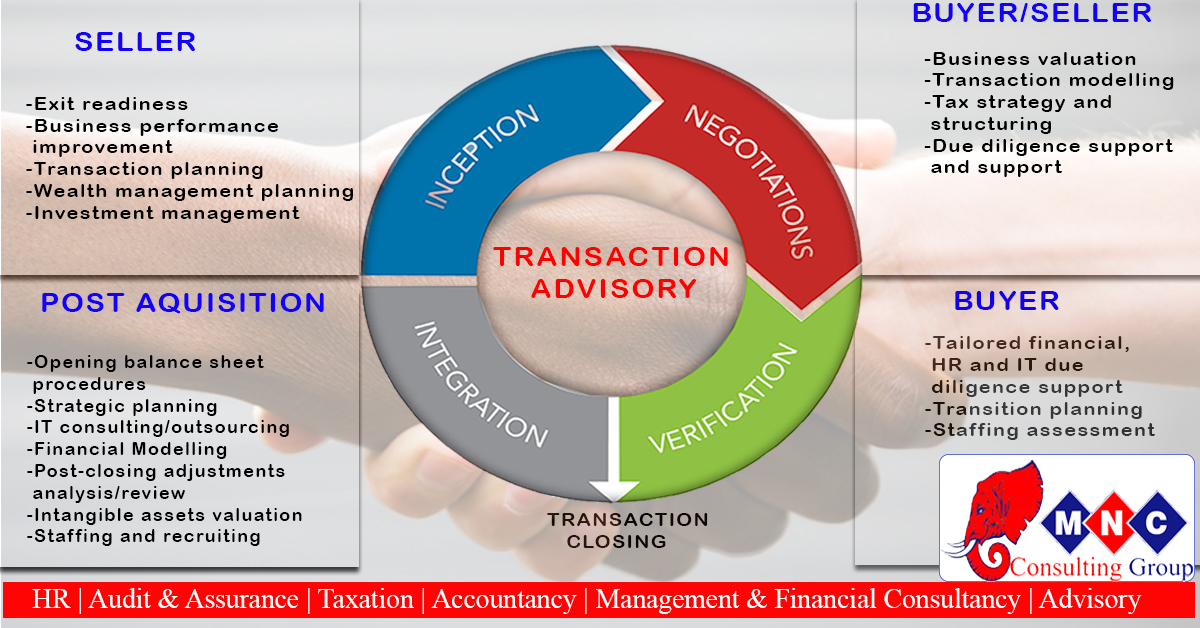

This action makes certain the organization looks its ideal to potential purchasers. Obtaining the service's value right is vital for an effective sale. Advisors make use of different methods, like affordable cash flow (DCF) evaluation, comparing with comparable firms, and current deals, to identify the fair market worth. This helps set a reasonable rate and bargain properly with future buyers.Deal experts action in to assist by getting all the needed information arranged, responding to concerns from buyers, and organizing visits to the service's location. This constructs trust with purchasers and keeps the sale moving along. Obtaining the finest terms is vital. Purchase experts utilize their knowledge to assist company owner take care of tough negotiations, meet customer expectations, and framework deals that match the owner's goals.

Satisfying legal policies is crucial in any organization sale. Deal advising solutions collaborate with legal professionals to develop and evaluate agreements, agreements, and other lawful papers. This decreases dangers and makes certain the sale adheres to the law. The function of purchase consultants expands past the sale. They assist entrepreneur in intending for their following actions, whether it's retired life, starting a new venture, or handling their newfound wealth.

Deal consultants bring a wide range of experience and understanding, ensuring that every facet of the sale is handled professionally. Via calculated prep work, evaluation, and settlement, TAS helps service proprietors attain the greatest possible price. By guaranteeing lawful and regulative compliance and handling due diligence alongside various other deal employee, purchase experts reduce potential threats and responsibilities.

Unknown Facts About Transaction Advisory Services

By contrast, Huge 4 TS teams: Work with (e.g., when a possible buyer is performing due persistance, or when a bargain is closing and the buyer needs to integrate the company and re-value the vendor's Equilibrium Sheet). Are with fees that are not linked to the bargain shutting efficiently. Make fees per interaction someplace in the, which is less than what investment financial institutions earn even on "little offers" (however the collection possibility is likewise much higher).

, but they'll concentrate extra on accountancy and valuation and less on subjects like LBO modeling., and "accounting professional just" topics like test balances and how to stroll with occasions using debits and credit histories instead than financial statement changes.

A Biased View of Transaction Advisory Services

that show exactly how both metrics have actually changed based upon items, channels, and clients. to evaluate the accuracy of monitoring's past forecasts., consisting of aging, stock by product, typical degrees, and stipulations. to figure out whether they're entirely imaginary or rather believable. Professionals in the TS/ FDD teams may likewise talk to management about everything over, and they'll create a thorough record with their findings at the end of the process.

, and the basic shape looks like this: The entry-level function, where you do a whole lot of data and economic analysis (2 years for a promotion resource from here). The next degree up; comparable job, but you get the more intriguing bits (3 years for a promotion).

In particular, it's challenging to obtain promoted beyond the Supervisor degree because few individuals leave the job at that stage, and you need to begin showing evidence of your capacity to create earnings to breakthrough. Let's begin with go now the hours and way of living given that those are easier to describe:. There are occasional late evenings and weekend work, but nothing like the frantic nature of financial investment financial.

There are cost-of-living adjustments, so anticipate lower settlement if you're in a less costly area outside major economic (Transaction Advisory Services). For all settings other than Companion, the base pay comprises the bulk of the overall settlement; the year-end bonus offer might be a max of 30% of your base pay. Often, the finest means to boost your profits is to switch to a different company and negotiate for a higher salary and benefit

Transaction Advisory Services Fundamentals Explained

You might enter into company advancement, however investment financial gets more hard at this phase since you'll be over-qualified for Analyst functions. Business financing is still an alternative. At this phase, you ought to just remain and make a run for a Partner-level function. If you wish to leave, possibly transfer to a client and do their evaluations and due persistance in-house.

The primary trouble is that due to the fact that: You normally need to join an additional Huge 4 team, such as audit, and work there for a few years and after that relocate into TS, work there for a couple of years and after that relocate into IB. And there's still no guarantee of winning this IB role due to the fact that it relies on your area, clients, and the working with market at the time.

Longer-term, there is likewise some danger of and since assessing a company's historical economic info is not precisely rocket science. Yes, humans will always require to be included, but with even more advanced innovation, reduced headcounts can possibly sustain client interactions. That said, the Purchase Solutions team beats audit in terms of pay, he has a good point work, and leave opportunities.

If you liked this short article, you may be interested in analysis.

A Biased View of Transaction Advisory Services

Develop advanced financial frameworks that help in establishing the real market price of a company. Give consultatory operate in connection to service appraisal to aid in bargaining and prices structures. Clarify the most appropriate form of the deal and the type of factor to consider to employ (cash, supply, earn out, and others).

Execute assimilation planning to identify the procedure, system, and business changes that might be called for after the deal. Establish standards for integrating divisions, modern technologies, and organization procedures.

Analyze the possible customer base, sector verticals, and sales cycle. The functional due diligence uses essential insights right into the functioning of the firm to be gotten worrying risk assessment and worth creation.